Secure Growth Plan

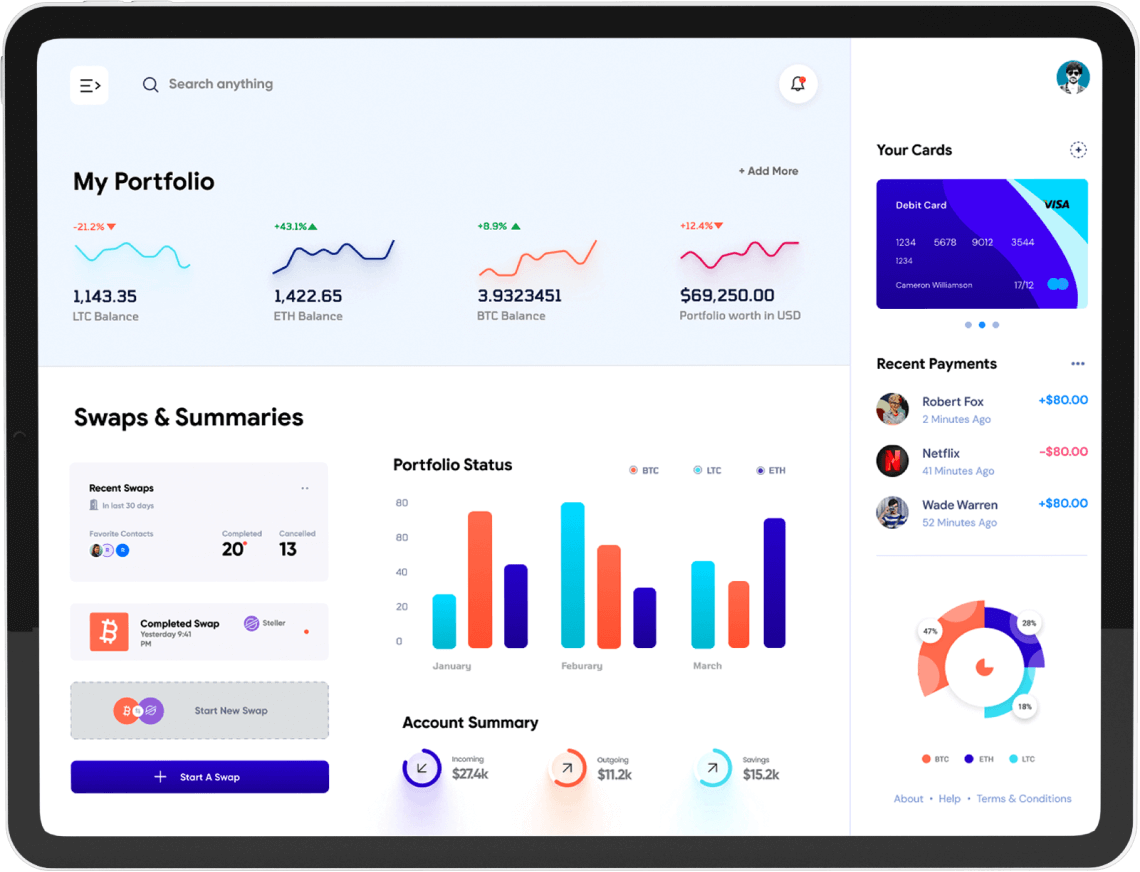

Looking to make a one-off investment with targeted 12% returns?

Our Secure Growth Investment Plan is designed to help you grow your wealth and achieve your financial goals.

What Is a Secure Growth Investment?

Lump Sum Investments involve a one-time, large investment made into a specific asset or portfolio. The goal is to achieve a significant return, usually over a shorter time frame compared to Secure Growth Plans.

Benefits of Secure growth Plan

Still unsure about investments and wondering how you can achieve a 12% return?

Advantages of Secure Growth Investments

Invest now for your bright future

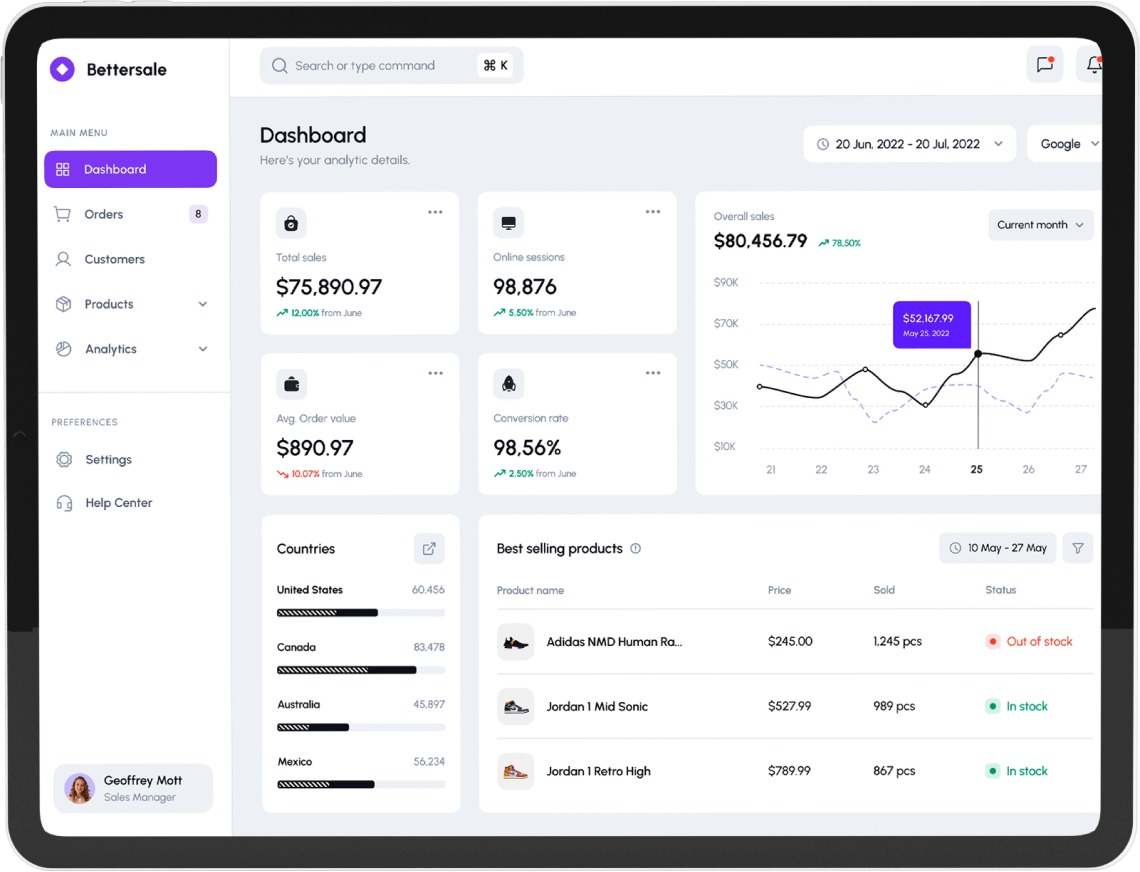

How to invest in Secure Growth Plan

- Select Your Plan: Choose the Secure Growth Plan for steady returns with a Targeted 12% growth.

- Decide Your Investment Amount: Select how much you’d like to invest, starting from a minimum of £5,000, based on your financial goals.

- Complete the Application: Provide your details and submit the required documents to finalise your application.

- The Lock-in Period: Note that the minimum lock-in period for this plan is 12 months, ensuring stable returns.

- Make Your Payment: Follow the instructions to complete your one-time lump-sum investment.

For more detailed information about SIPs, please click here which redirects to our blog and explore all the insights we’ve shared.

Frequently

Asked Questions

You invest a lump sum amount, which is managed by professionals to generate steady returns over a specified period.

The plan offers predictable returns, low risk, and is ideal for individuals seeking financial growth without regular contributions.

Yes, the minimum investment amount varies based on the terms of the plan. Please refer to the company's guidelines.

This plan typically aims for a targeted 12% annual return.

Anyone looking for a secure, low-risk investment option to achieve financial goals can invest.

Visit the company’s website, select the Secure Growth Investment Plan, choose your investment amount and duration, and complete the application process.